From Loss to Profit: The First RWA Stock Figure Is About to Go Public

On August 19, Figure Technology Solutions (FTS)—a fintech company founded by SoFi co-founder and former CEO Mike Cagney—filed its IPO registration with the U.S. Securities and Exchange Commission (SEC), planning to list on Nasdaq under the ticker FIGR and officially initiating its public offering process. Unlike traditional financial institutions that follow conventional playbooks, Figure built its platform from the ground up with blockchain as its core, using blockchain technology to revolutionize both home equity loans and crypto-backed lending.

Mike Cagney, who previously initiated significant innovation in online finance with SoFi, now aims to disrupt the business models that traditional banks have long relied on—this time, with blockchain. He commented, “The capital validates our vision of redefining capital markets through blockchain technology. We’re already seeing real benefits by leveraging blockchain in our lending and capital markets operations.”

Entering Home Equity: The Largest Non-Bank HELOC Provider in the U.S.

In the mortgage space, Figure has struck at the heart of banks’ weaknesses—speed and transparency. Traditional HELOC applications could take weeks, sometimes months. On Figure’s platform, borrowers complete the process entirely online, receiving approval in as little as 5 minutes and funding within 5 days.

To date, Figure has helped over 200,000 families unlock $16 billion in home equity, making it one of America’s top non-bank HELOC providers. What’s especially notable is that this efficiency isn’t achieved by “relaxing” underwriting, but by leveraging Figure’s proprietary Provenance blockchain. Built on Cosmos SDK, this public, proof-of-stake blockchain enables instant finality—once a transaction is confirmed, it can’t be reversed—ensuring secure and transparent loan settlement.

Provenance standardizes each loan’s record on-chain and provides immutability, while also directly connecting with Figure Connect—its native on-chain private capital markets platform. Here, lenders and investors can match, price, and settle loans entirely on-chain, reducing processes that previously required months to mere days and redefining the efficiency of private credit transactions.

Crypto-Backed Lending: Balancing holding (HODLing) and Liquidity

If HELOCs gave Figure a strong footing in traditional lending, then crypto-backed loans are its breakthrough in the digital asset space.

With this offering, customers can use Bitcoin (BTC) or Ethereum (ETH) as collateral to borrow up to 75% of the asset value (LTV), with rates as low as 8.91% for a 50% LTV, and no credit score required.

All collateral is held in decentralized, segregated multi-party computation (MPC) custody wallets. Clients can directly view on-chain addresses to confirm that funds are never misused. As a result, even while leveraging BTC or ETH as collateral, clients can continue to hold (HODL) for potential price appreciation, while putting borrowed cash to work—paying off debt, buying a home, renovating, or even increasing their crypto exposure.

This design is especially attractive in bull markets—investors get liquidity without selling, retaining upside potential; and in bear markets, it can provide emergency liquidity through collateralization, helping avoid forced liquidations.

Expanding into Crypto: Dual Engines of RWA and Stablecoins

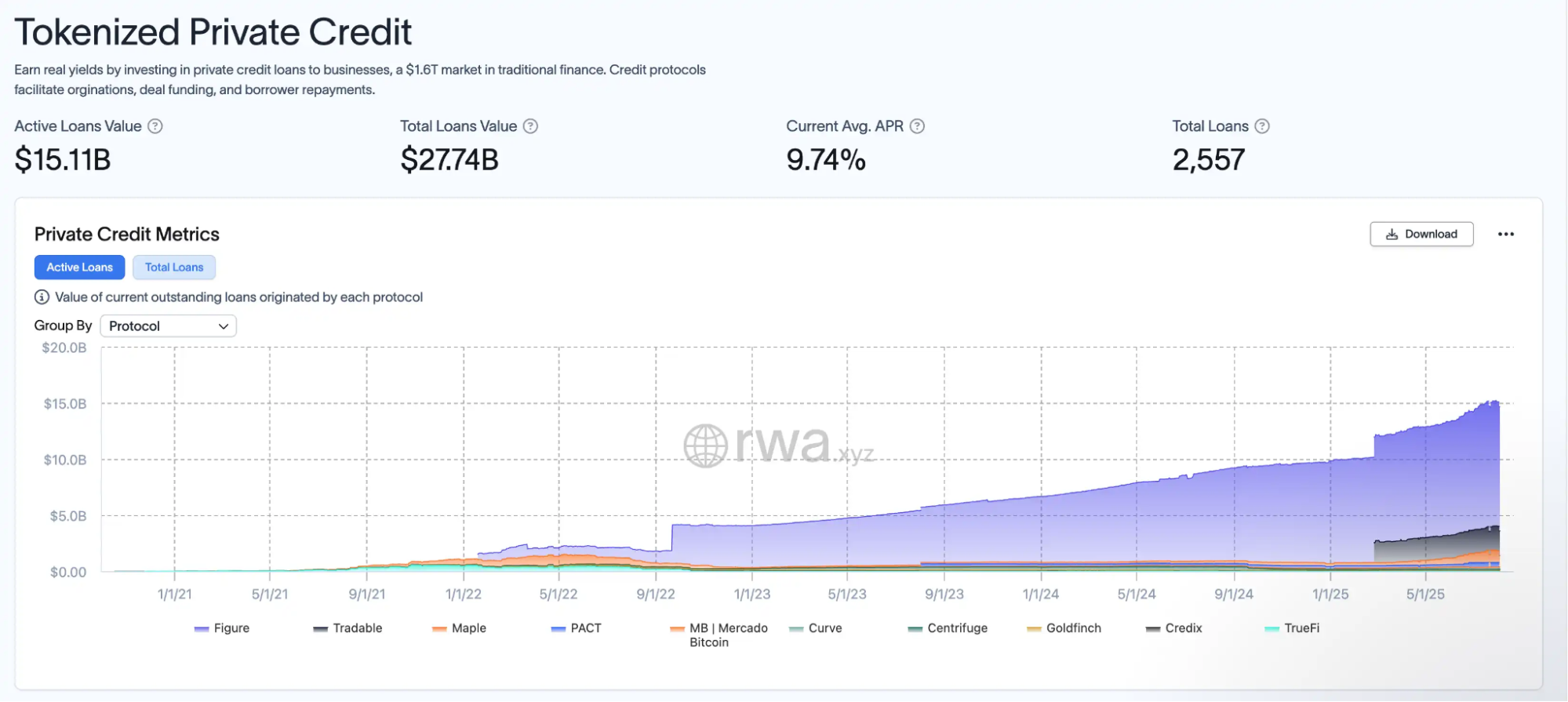

Figure’s ambitions go well beyond home equity and crypto lending. By leveraging Provenance blockchain, Figure has originated $13 billion in loans within the $27.74 billion tokenized private credit market, with $11 billion currently active—a utilization rate above 84%. According to rwa.xyz, Figure ranks first among private credit issuers. Whether the underlying asset is home equity or private credit, Figure digitizes and programs these assets for standardized on-chain issuance and trading. These blockchain-native assets work seamlessly with DeFi protocols, allowing funds that were previously trapped in traditional finance to move, be collateralized, and reused globally—effectively blurring the boundaries between TradFi and DeFi.

Meanwhile, Figure Markets’ YLDS stablecoin is the world’s first SEC-approved interest-bearing stablecoin, pegged 1:1 to the U.S. dollar and paying a ~3.79% annual yield (SOFR minus 50bps). YLDS not only offers best-in-class compliance, but also stable returns, supporting payments, cross-border settlements, secured borrowing, and more. This “RWA + stablecoin” model positions Figure to capture upside in both real-world and digital asset markets. It also positions Figure at the forefront of the next multi-trillion-dollar market opportunity.

Capital Strategy and IPO Readiness

In just a few years, Figure completed multiple funding rounds with backing from DCM Ventures, DST Global, Ribbit Capital, Morgan Creek Digital, and secured billions in debt facilities from Jefferies, JPMorgan, and others. Market reports indicate top Wall Street firms such as Goldman Sachs and JPMorgan are among the lead underwriters for this IPO.

Previously, Figure restructured its organization, bringing Figure Lending LLC into the Figure Technology Solutions umbrella and building an executive team with deep regulatory and governance expertise to clear the path to public markets.

The company’s financials are equally impressive. In the first half of 2025, Figure generated $191 million in revenue—a 22.4% year-over-year increase—with $29 million in net income, a dramatic swing from the $13 million net loss in the same period last year. This shows Figure has exited the loss stage typical of early expansion and confirms robust market demand for blockchain-driven lending and financial services.

In its registration statement, Figure emphasizes its core advantage: using blockchain to inject liquidity into traditionally illiquid markets. Asset tokenization is key to lowering funding costs and breaking down financial silos. After the IPO, CEO Cagney will retain majority voting control, ensuring strategic direction stays in-house. While this dual-class structure supports long-term vision, it does raise questions about shareholder rights.

For context, Figure completed a $200 million funding round in 2021, reaching a $3.2 billion valuation. While the IPO valuation is not public yet, analysts remain bullish: with Figure returned to profitability and firmly positioned at the intersection of fintech and blockchain, the company may be entering its prime window for capital markets attention.

In the IPO Disclaimer, Cagney noted, “The value of blockchain far exceeds mere financial disruption. By tokenizing previously illiquid assets and bringing historical data on-chain, we’re able to inject new energy into markets. This IPO is just a small step in blockchain’s broader capital markets journey.”

Conclusion

2025 could go down as the first true year of tokenized stocks. From the rise of “MicroStrategy-style altcoin strategies,” to CRCL’s tenfold pop within a month of IPO, and major crypto firms like Kraken gearing up for Wall Street—the convergence of capital and on-chain markets is reaching new depths.

The market is closely watching for the emergence of a real RWA giant—an entity capable of bringing trillions in real-world value onto the blockchain and redefining markets just as Bitcoin and Ethereum did. Figure is actively pursuing that position, and its next move might well make history.

Disclaimer:

- This article is reprinted from [BlockBeats]. Copyright belongs to the original author [kkk]. If you have any concerns about this reprint, please contact the Gate Learn team, who will address the matter promptly in accordance with established procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translations without proper attribution to Gate.

Related Articles

Reshaping Web3 Community Reward Models with RWA Yields

ONDO, a Project Favored by BlackRock

Real World Assets - All assets will move on-chain

What Are Crypto Narratives? Top Narratives for 2025 (UPDATED)

Gate Research: Understanding the Core Logic and Hot Projects of RWA in One Article