Gate Research|The Institutional Shift into Crypto: Drivers, Strategies, and the Road to Market Maturity

With the clarification of regulatory policies and the continuous improvement of infrastructure, the crypto market is undergoing a profound transformation led by institutional capital. Since 2024, landmark events such as the passage of the Stablecoin Act and the implementation of the MiCA regulations in the European Union have driven crypto assets to transition from "marginal speculative instruments" to "institutional core allocations." Traditional financial giants like Strategy, BlackRock, Fidelity, and Nomura have been actively pursuing full-stack strategies, encouraging diverse institutions such as pension funds, sovereign wealth funds, and university endowments to gradually increase their involvement.Introduction

After the industry-wide crackdown, trust crisis, and regulatory overhaul from 2022 to 2024, the crypto market in 2025 has entered a new institution-led transformation cycle. With regulatory frameworks becoming increasingly clear and compliant channels fully opening up, crypto assets are gradually shedding their label as “marginal assets” and are now becoming a “core allocation” in an increasing number of institutional portfolios.

This wave of institutionalization has been driven by a series of landmark policies and market events:

- The passage of the Genius Act and the SEC’s formal approval in 2024 of spot Bitcoin ETFs — including those launched by major players such as BlackRock, Fidelity, and ARK — marked the comprehensive opening of mainstream, compliant entry channels;

- The introduction of Hong Kong’s Stablecoin Ordinance, which established a licensing regime for stablecoin issuers, laying the foundation for Asia’s leading regulatory framework for crypto assets;

- The full implementation of the EU’s MiCA regulation, which unified stablecoin and crypto asset regulation across the European Union and provided a legal foundation for cross-border institutional investment;

- A statement from Russia’s Ministry of Finance in support of bringing crypto assets “out of the shadows,” opening compliant trading channels for high-net-worth investors;

- Traditional financial institutions actively enter space — with BlackRock, Franklin Templeton, Nomura, Standard Chartered, and others making moves into digital asset management, custody, payments, and foundational infrastructure.

The regulatory clarity has led to a restoration of market confidence and a restructuring of capital flows. According to the Institutional Digital Assets Survey published by EY-Parthenon in 2025, over 86% of institutional investors globally have either already invested in or plan to invest in crypto assets within the next three years. Research from Nomura also indicates that more than half of institutional players in Japan have already incorporated digital assets into their strategic outlook.

Against this backdrop, this report will systematically examine the motivations behind institutional investors’ allocation to crypto assets, focusing on the evolution of their investment strategies, differentiated allocation paths, and shifting modes of market participation. Through case studies, it will further reveal the structural opportunities emerging in the crypto asset market in this new “institutional era.”

Motivations Behind Institutional Participation

Digital assets have gradually evolved from being perceived as “high-volatility” and “high-risk” fringe assets into an increasingly essential component of institutional portfolios. According to multiple surveys, over 83% of institutional investors plan to maintain or increase their allocation to digital assets in 2025, with a significant proportion intending to substantially increase their exposure. The motivations behind institutional involvement stem not only from the unique characteristics of digital assets themselves, but also from the maturation of supporting technological infrastructure and a growing confidence in future technological trends.

2.1 High Returns and Risk Diversification

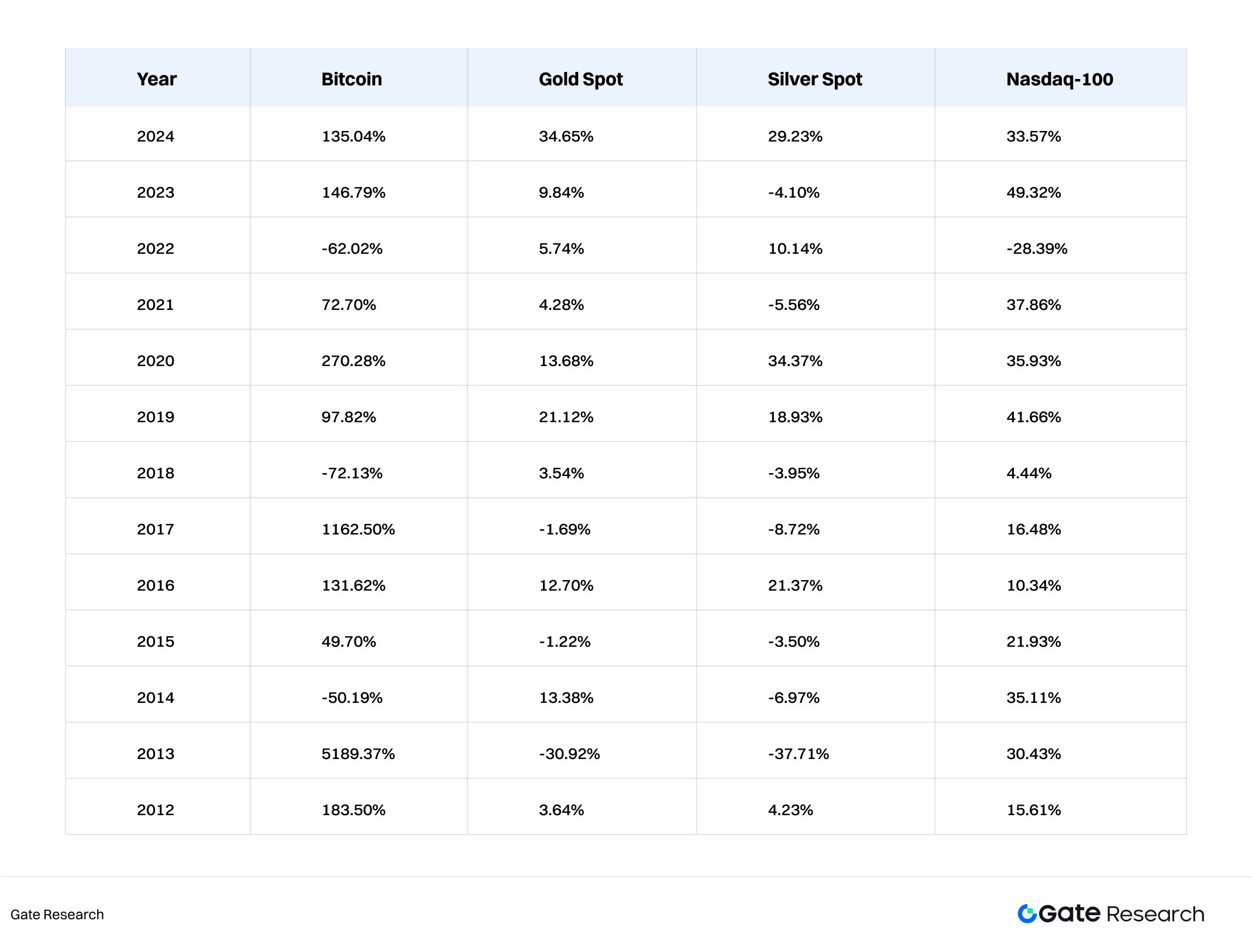

Since 2012, cryptocurrencies such as Bitcoin (BTC) have consistently outperformed traditional assets like gold, silver, and the Nasdaq in terms of returns. BTC has delivered an average annualized return of 61.8%, while ETH (Ethereum) has averaged 61.2%, significantly higher than most legacy assets. At the same time, traditional institutional portfolios are facing diminishing marginal returns. In the post-pandemic era, marked by high inflation and policy rate uncertainty, institutions are increasingly inclined to seek low-correlation assets as a means of hedging and diversification.

Studies have shown that Bitcoin’s correlation with equities has averaged below 0.25 over the past five years, and its correlation with gold has remained in the 0.2 to 0.3 range. Its relationship with emerging market currencies and commodities — such as those in Latin America and Southeast Asia — is even more decoupled. This makes crypto assets a valuable tool for institutional investors seeking alpha generation, systemic risk hedging, and Sharpe ratio optimization.

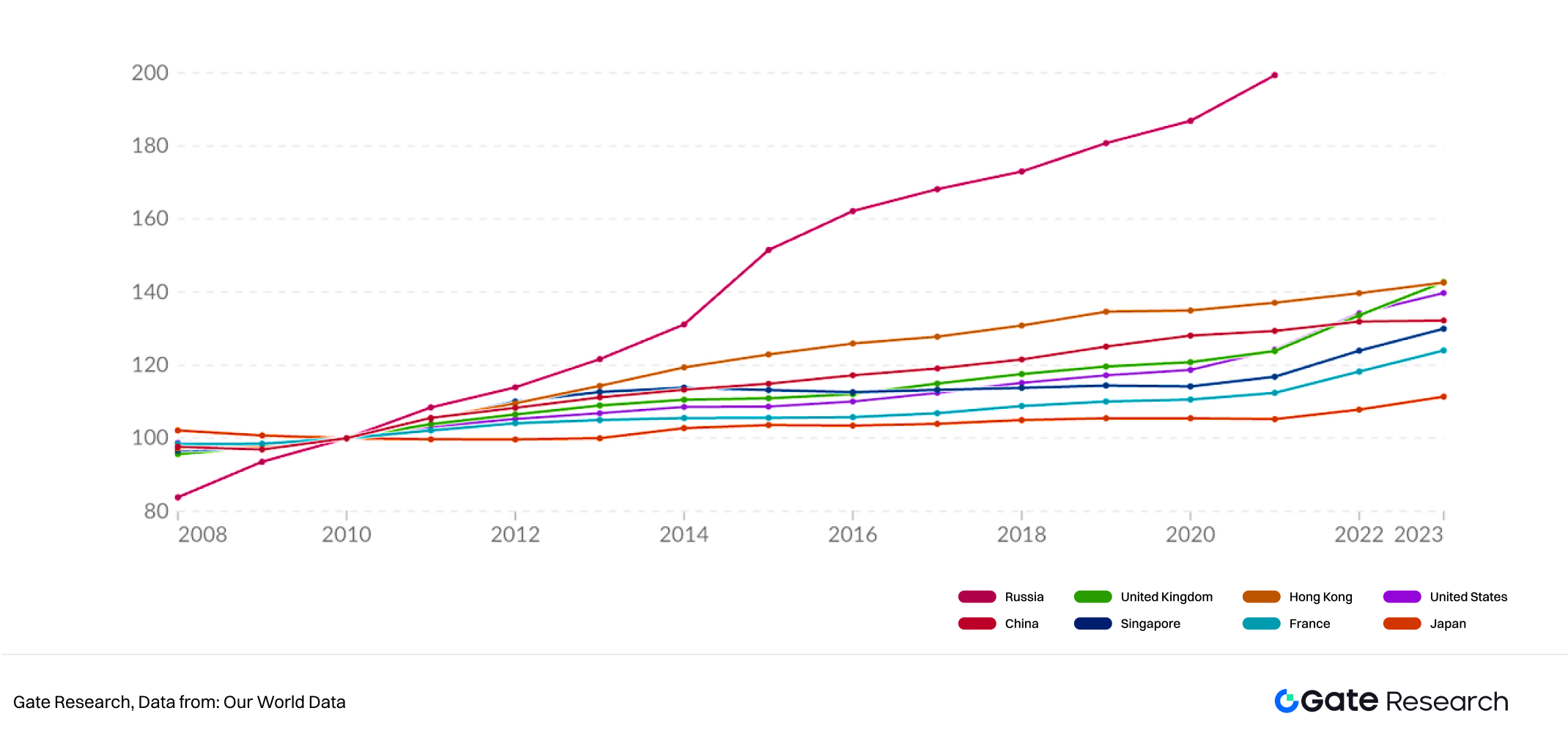

2.2 Strategic Demand for Inflation Hedging and Fiat Currency Devaluation Protection

Since 2020, global quantitative easing has led to widespread appreciation across major asset classes, making inflation the primary concern for investors worldwide. Crypto assets — particularly Bitcoin — are increasingly seen as a hedge against fiat currency devaluation, thanks to their technically enforced fixed supply of 21 million coins. This scarcity feature positions BTC as “digital gold,” well-suited for long-term value preservation. BlackRock’s Chief Investment Officer, Rick Rieder, publicly stated: “Over the long term, Bitcoin is more like a store of value than just a transactional currency.”

2.3 Infrastructure and Settlement Efficiency Improvements

One of the core concerns that has long made institutional investors cautious about crypto assets is the lack of transparency in settlement processes, absence of standardized custody solutions, and heightened counterparty risk. In its early days, the crypto market resembled a form of “shadow finance”, lacking central clearing systems, regulated custodians, and standardized risk control frameworks similar to those in traditional finance. For large institutions, such uncertainty—particularly around post-trade settlement and fund security—constituted a material risk in itself.

However, in recent years, the crypto infrastructure landscape has undergone qualitative transformation, particularly in the following key areas:

- Custody Services Entering the Regulatory Mainstream A growing number of custody providers have obtained trust licenses from financial regulators, enabling them to offer compliant custody solutions to institutional clients. For example, Fidelity Digital Assets provides end-to-end custody and trade execution services for institutions, with operations now expanding into Asia and Europe. These platforms implement cold storage separation, multi-signature wallet structures, insurance protection, attack-mitigation systems, and real-time audits—significantly boosting institutional confidence in fund security.

- Professionalization of Clearing and Matching Mechanisms On the trading front, traditional CEX and OTC processes were historically hindered by the absence of clearing intermediaries, often resulting in delays and counterparty risk. Platforms such as Gate.io and financial institutions have started to implement clearing and matching systems modeled after traditional financial markets.

- Improved Settlement Efficiency Enables Cost Reduction and Better Risk Control In traditional finance, cross-border payments and securities settlement often take several days and incur high costs. In contrast, the on-chain settlement mechanisms inherent to crypto markets offer high efficiency and minimal intermediary reliance. When paired with the custodial and clearing infrastructures mentioned above, institutions can achieve T+0 trade settlement and 24/7 operational continuity, eliminating time-zone constraints and enabling the seamless global circulation of assets.

2.4 Technology-Driven Participation in Future Financial Models

Institutional participation in the crypto market also reflects a strategic bet on future technological paradigms. Emerging sectors such as Web3, DeFi, and Real-World Assets (RWA) are expected to reshape how financial services are delivered and how assets are represented.

Examples include:

- Swiss banks participating in on-chain issuance of RWA-backed bonds;

- Citibank is launching a platform for tokenized deposits;

- JPMorgan deploying its Onyx project for enterprise-grade blockchain settlement.

In these transformative processes, early movers enjoy a significant first-mover advantage.

2.5 Client Demand and the Next Generation’s Asset Preferences

Many institutional investors — particularly pension funds and insurance companies — are undergoing a generational shift in their client base. Millennials and Gen Z are more familiar with digital assets, pushing institutions to reassess their asset allocation models. A 2024 report by Fidelity noted that nearly 60% of millennial clients want to see BTC or ETH included in their retirement portfolios. This changing preference is accelerating the diversification and democratization of institutional crypto product offerings.

Institutional Investment Strategy Analysis

As the crypto market becomes increasingly institutionalized and the structure of digital assets continues to mature, institutional participation is growing more diverse. From exploratory allocations to multi-strategy portfolio construction, institutional crypto investment is exhibiting a clear trend toward stratification, strategic sophistication, and structural integration. This chapter analyzes the typical entry strategies and asset preferences of different types of institutions across three key dimensions: institutional type, investment style, and allocation path.

3.1 By Institutional Type: Heterogeneous Strategies Driven by Institutional Nature

Institutional investors are not a homogeneous group; they represent a diverse ecosystem with varying risk appetites, allocation mandates, and liquidity requirements. Typical players include family offices, pension funds & sovereign wealth funds, and university endowments, each showing distinct investment behaviors in the crypto space.

3.1.1 Family Offices

- Tend to have higher risk tolerance and openness to asset innovation, with flexible allocation goals;

- Favor early-stage token projects, crypto-native venture funds, and on-chain yield strategies;

- Commonly engage through direct token holdings, private token sales, or indirect investments via Web3 venture funds. Case: Multiple family offices in Singapore and Switzerland have actively participated in Ethereum staking services and seed-round funding for Web3 infrastructure projects such as Rollups and oracles.

3.1.2 Pension Funds & Sovereign Wealth Funds

- Prioritize long-term stability and macro-level hedging capabilities, typically adopting conservative allocation styles;

- Prefer regulated products such as spot ETFs and bond-like Real-World Assets (RWAs);

- Usually they gain indirect exposure via large asset management platforms like BlackRock or Fidelity. Case: Norway’s sovereign wealth fund Norges Bank disclosed in its 2024 annual report holdings in Coinbase equity and BTC ETF products, signaling a move by sovereign capital into digital assets via equity channels.

3.1.3 University Endowments & Foundations

- Driven by a focus on technological innovation and frontier trends;

- Participate through top-tier Web3 venture funds such as a16z crypto, Paradigm, and Variant;

- Tend to favor early-stage thematic investments including Layer 2 scaling, privacy computing, and AI+Crypto convergence. Case: Endowments from Harvard, MIT, and Yale have maintained long-term positions in Web3-focused funds, with high participation in data composability and base-layer protocol innovations

3.2 By Investment Style: Coexistence of Active and Passive Strategies

Institutional approaches to crypto investment can broadly be categorized into active and passive strategies, reflecting divergent preferences for risk-return profiles and operational resource commitments.

3.2.1 Active Allocation Strategies

- Institutions build in-house research teams to conduct on-chain analytics and off-chain valuation modeling;

- Strategies include arbitrage, staking, DeFi liquidity mining, volatility/Gamma trading, and protocol governance participation;

- Emphasize flexibility and frontier capture, often involving multi-chain, multi-asset, and cross-protocol portfolio structures. Case: Franklin Templeton has built a digital asset fund management platform offering Staking-as-a-Service and DeFi liquidity deployment, exemplifying institutional implementation of active strategies.

3.2.2 Passive Allocation Strategies

- Primarily use ETFs, structured notes, and fund shares to gain exposure indirectly;

- Focus on controlled NAV volatility and transparent risk exposure;

- Allocations typically concentrate on high market-cap assets like BTC and ETH, with occasional exposure to stablecoin-based yield strategies. Case: The Multi-Asset Digital Index Fund launched in 2025 gained traction among pension funds and insurance institutions, aiming to build low-correlation asset pools.

3.3 By Allocation Path and Asset Preference: From “Buying Coins” to “Building Systems”

In practice, institutions are no longer viewing crypto as a single-asset bet, but rather as a strategically segmented sub-portfolio within their broader asset framework. These allocation paths can be broadly categorized into three models:

3.3.1 Core Asset Allocation (BTC / ETH)

- As “digital gold” and the “operating system of Web3,” BTC and ETH constitute the foundational layer of most institutional portfolios;

- BTC serves primarily as a store of value and inflation hedge;

- ETH represents a structural bet on on-chain economies, including DeFi, RWA, and Layer 2 ecosystems.

3.3.2 Thematic and High-Growth Sector Allocation

- Focus on high-beta, high-growth sectors such as Layer 2 scaling (e.g., Arbitrum), modular blockchains (e.g., Celestia), AI-powered protocols (e.g., Bittensor), and decentralized storage (e.g., Arweave);

- Investment methods favor early-stage private placements and venture fund LP commitments, suited for institutions with higher risk tolerance;

- Designed to capture structural alpha and mid-to-long-term growth potential.

3.3.3 Infrastructure and Compliance-Oriented Allocation

- Targets include regulated custody providers (e.g., Anchorage), on-chain risk control platforms, and DePIN (Decentralized Physical Infrastructure Networks);

- Viewed as non-token assets with regulatory moats and long-term technical value;

- Appropriate for institutions like sovereign wealth funds and university endowments with a strategic outlook on crypto ecosystem infrastructure.

3.4 Summary

A cross-sectional analysis of institutional type, investment style, and allocation path reveals that institutional crypto investment has evolved far beyond “just buying tokens.” Institutions are now building multi-strategy, multi-path, cross-sector asset allocation systems.

This structural evolution reflects:

- A growing sophistication in how institutions understand the nature of digital assets and their macro implications;

- Deeper engagement with technological paths, governance structures, and regulatory trajectories.

Looking ahead, as compliant product offerings expand and infrastructure continues to mature, institutional strategies will become increasingly diversified and finely segmented—laying the groundwork for crypto assets to establish themselves as a stable anchor within the global asset allocation system.

Case Study

Over the past year, institutional interest in crypto assets has continued to intensify. A growing number of public companies and investment institutions have increased their exposure to major crypto assets such as Bitcoin (BTC) and Ethereum (ETH) through direct purchases, portfolio expansions, or long-term holdings. This trend reflects not only traditional financial capital’s growing recognition of the crypto market but also highlights the inflation-hedging and portfolio diversification potential of assets like Bitcoin.

4.1 MicroStrategy

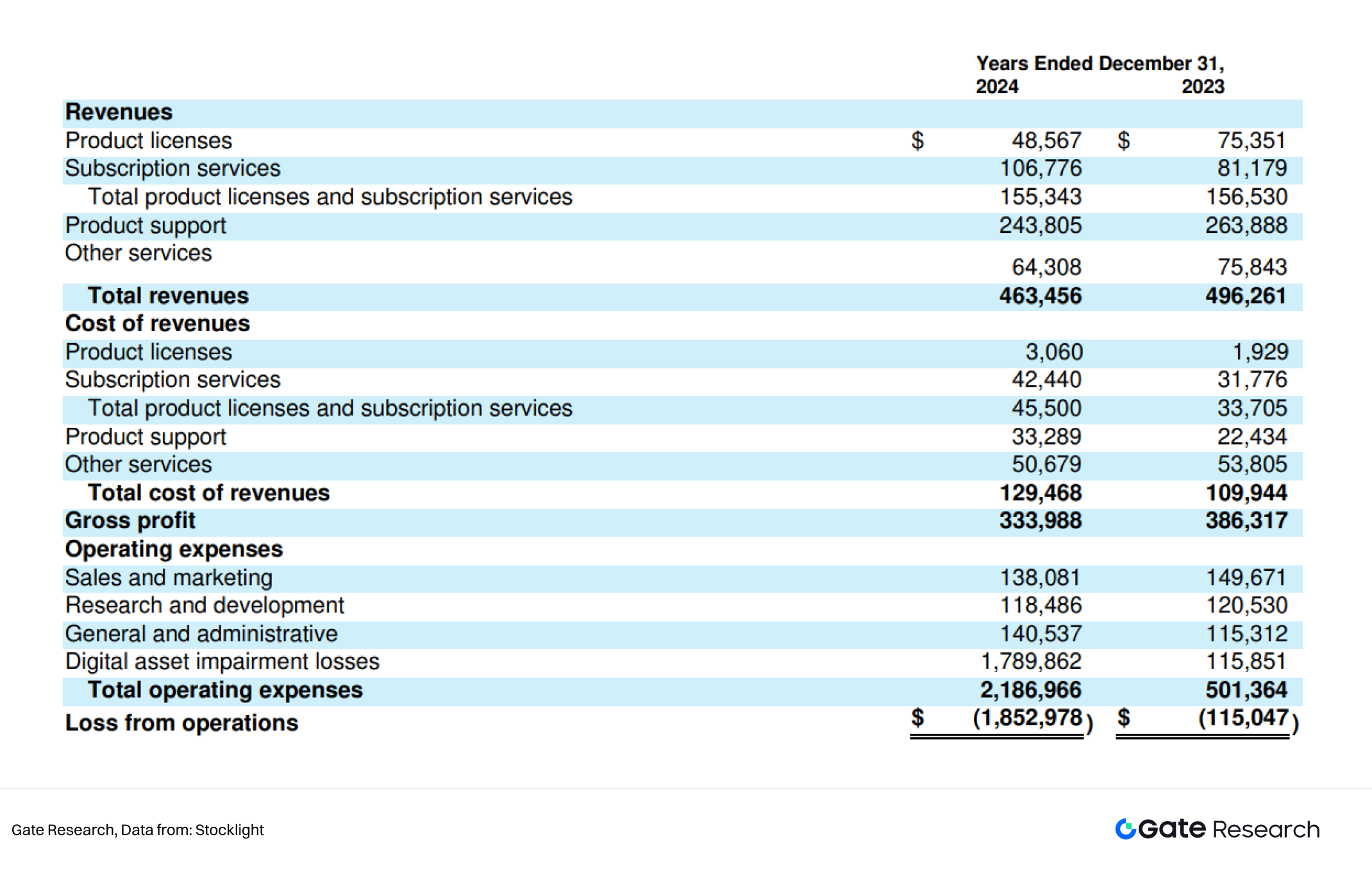

MicroStrategy (NASDAQ: MSTR), originally a traditional technology company focused on business intelligence (BI) software, was founded in 1989. The company has long specialized in enterprise data analytics and reporting services. Despite a solid client base among large enterprises, MicroStrategy’s core business growth had stagnated over the past decade, facing revenue plateau and profitability challenges.

Amid macroeconomic shifts, rising inflationary pressures, and declining returns on fiat-denominated assets, MicroStrategy’s leadership began re-evaluating the structure of its balance sheet and the efficiency of corporate capital deployment.

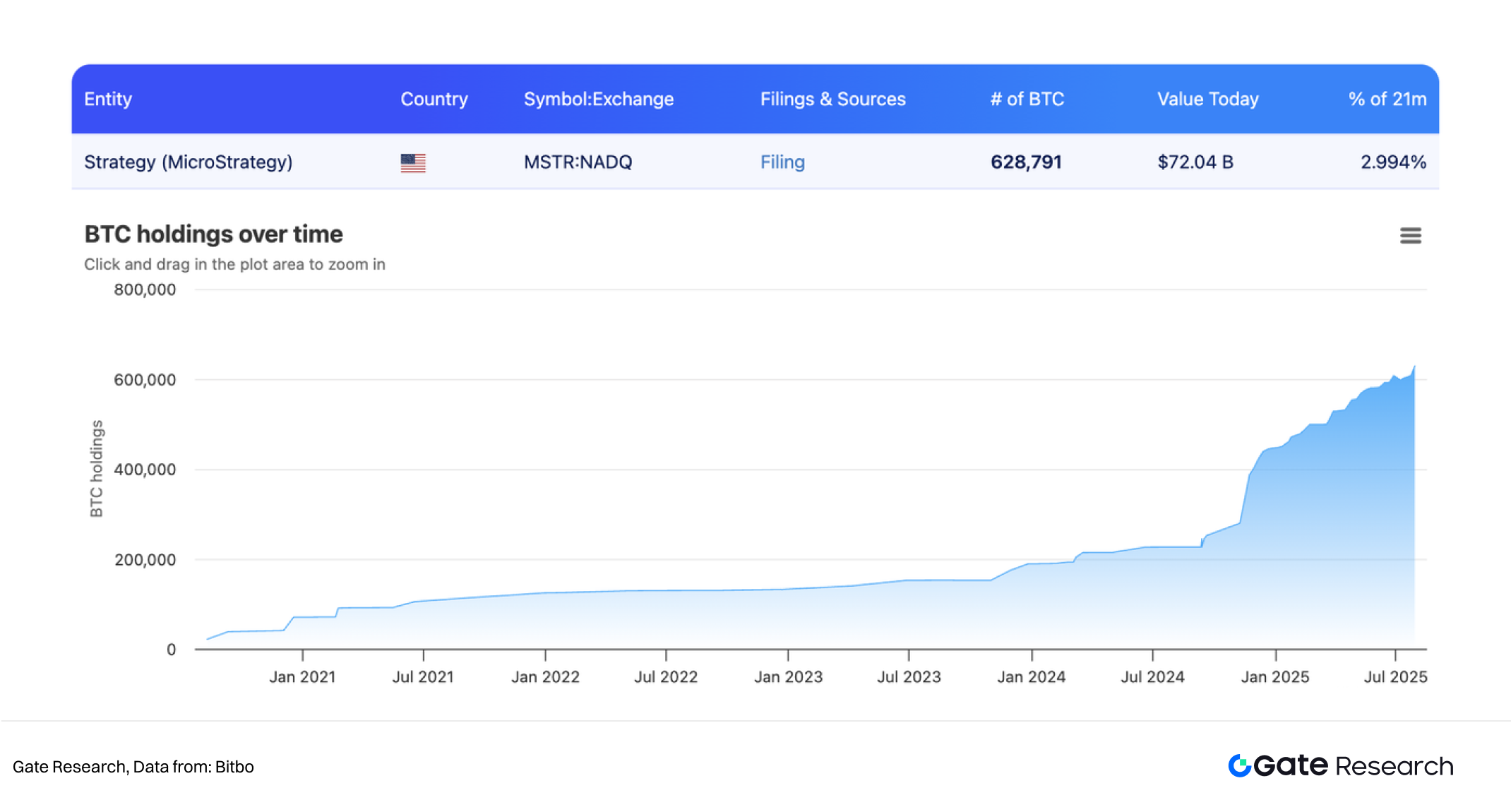

In 2020, under the leadership of then-CEO Michael Saylor, the company initiated a bold and controversial strategic pivot: adopting Bitcoin as its primary treasury reserve asset.

In August 2020, MicroStrategy made its first Bitcoin purchase—acquiring 21,454 BTC for $250 million. Between 2020 and 2024, the company continued to accumulate Bitcoin through multiple rounds, ultimately bringing its total holdings to over 620,000 BTC, with a total acquisition cost exceeding $21 billion.

Notably, this aggressive accumulation strategy was not solely financed with the company’s own capital. Instead, MicroStrategy leveraged a variety of capital market instruments—including convertible bond issuances, private placements, and ATM (at-the-market) equity offerings—to implement a “debt-plus-leverage” approach, aiming to amplify its BTC exposure and return potential.

This capital strategy not only effectively mobilized external funds but also gradually transformed MicroStrategy into a Bitcoin proxy vehicle. As a result, its stock price became highly correlated with BTC, and it has increasingly been regarded by investors as a de facto early-stage alternative to a Bitcoin ETF.

This “corporate Bitcoin treasury + capital market financing + BTC revaluation” strategy has profoundly reshaped MicroStrategy’s business profile. According to its Q2 2025 earnings report, although the company’s core software business remains stable, the appreciation of its BTC holdings has become the primary driver of profitability. The company reported quarterly net profits exceeding $10 billion, and its stock price has risen more than 39% year-to-date. This transformation has not only redefined its capital market positioning, but also significantly enhanced its liquidity and balance sheet strength.

In early July 2025, MicroStrategy announced a $2.46 billion purchase of 21,021 BTC, pushing its total Bitcoin holdings close to an all-time high. However, in the following two weeks, the company did not disclose any further acquisitions, leading to market speculation that its accumulation phase may temporarily slow. This shift in pace highlights the flexibility and risk awareness institutions are adopting in response to market volatility.

As the first publicly traded company to hold digital assets at scale, MicroStrategy pioneered a new model of treating Bitcoin as a foundational corporate asset. Its strategy has served as a blueprint for other firms—such as Tesla, Square (Block), and Nexon—and has sparked broader discussions on how crypto assets can optimize corporate treasury structures.

From a traditional corporate perspective, MicroStrategy’s approach is not merely an investment decision, but a comprehensive strategy to hedge macroeconomic inflation, restructure capital efficiency, and pursue market revaluation opportunities. Today, with spot Bitcoin ETFs launched and institutional access channels rapidly expanding, MicroStrategy’s “corporate Bitcoin treasury” paradigm is evolving from a unique case into a systemic trend, offering a solid reference point for the ongoing institutionalization of the crypto market.

4.2 Bitmine

According to Bloomberg, Bitmine currently holds approximately 833,000 ETH, with a market value approaching $3 billion, making it one of the largest institutional holders of Ethereum. Unlike traditional Bitcoin-heavy strategies, Bitmine’s significant ETH position reflects its strong conviction in Ethereum’s long-term ecosystem potential, particularly in areas such as smart contracts, Layer 2 scaling, and asset tokenization.

4.3 Metaplanet

The Japanese public company Metaplanet recently acquired an additional 463 BTC for approximately $53.7 million, further increasing its total Bitcoin holdings. As a representative of emerging Bitcoin investors in the Asian market, Metaplanet’s continued accumulation aligns with Japan’s gradually clarifying digital asset regulatory framework, and may encourage more Asian corporations to consider a strategic shift in asset allocation.

4.4 Sequans and GameSquare

Beyond Bitcoin, several companies have begun to diversify into other major crypto assets. Sequans recently added 85 BTC, bringing its total holdings to 3,157 BTC, while GameSquare increased its ETH position by 2,717 ETH, raising its total to 15,630 ETH. These moves indicate that some institutions are actively exploring portfolio optimization through balanced exposure to both BTC and ETH. Additionally, an increasing number of firms are showing interest in emerging chains such as Solana, reflecting a growing focus on the next-generation Layer 1 landscape.

Future Trends

With regulatory clarity and infrastructure maturity accelerating, institutional investors are entering the crypto market at an unprecedented pace and depth. This trend is not a short-lived phenomenon, but rather a strategic choice rooted in macro-level hedging needs, portfolio optimization objectives, and expectations of technological dividends. The low correlation of crypto assets, their high potential returns, and the growing importance of blockchain as foundational financial infrastructure form the core drivers of institutional participation.

From a performance perspective, despite the inherent volatility of crypto markets, major assets such as Bitcoin and Ethereum have demonstrated robust long-term returns across several market cycles. The rapid growth of ETF products, outperformance of on-chain fund strategies, and the resilience of multi-strategy funds in low-correlation market environments all validate the effectiveness of institutional allocation.

Going forward, institutional participation in crypto will become increasingly diverse and systematized. This includes:

- Entry through ETFs and structured products,

- Integration of Real-World Assets (RWA) with on-chain securities issuance,

- Active roles as validator node operators or protocol governors within blockchain ecosystems,

- And the deployment of AI-driven, on-chain strategy execution platforms, where “model-as-investment” becomes a reality.

All of these signal a shift in crypto markets — from mere capital inflows to deep institutional integration and governance transformation.

In this ongoing evolution, first-moving institutions will not only serve as financial investors but also as architects and catalysts of the new financial order. Crypto assets are no longer merely a playground for speculators — they are becoming an integral component of the modern financial system.

Reference

- Ey, https://www.ey.com/content/dam/ey-unified-site/ey-com/en-us/insights

- Our World Data, https://ourworldindata.org/grapher/consumer-price-index

- Stocklight,https://stocklight.com/stocks/us/nasdaq-mstr/microstrategy/annual-reports

- Bitbo, https://bitbo.io/treasuries/historical

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024