Currently, about 12% of the total supply of Bitcoin is held by public companies, ETFs, and institutions, while only about 5.2% of Ether is controlled by institutions (and Ether still has an inflation mechanism), which is a significant gap from Wall Street's expectations. This also means that we are currently in the mid-stage of a capital structure transformation: retail investors are being continuously shaken out, while institutions are accelerating their entry and layout. In the future, the amount of Ether held by retail investors will decrease, while the chips in the hands of institutions wi

View OriginalChangmin

Be a trader like a mountain, steady and calm.

Pin

Changmin

I only do Spot trading, most of my funds are in btc and eth, a small part is for short-term Spot trading. I don't touch contracts and I don't over-leverage.

Occasionally share daily short-term operations

Friends interested in Spot, please give a follow. Welcome to exchange and learn.

#现货# #btc# #eth#

View OriginalOccasionally share daily short-term operations

Friends interested in Spot, please give a follow. Welcome to exchange and learn.

#现货# #btc# #eth#

- Reward

- like

- 1

- Repost

- Share

Changmin :

:

Spot trading is now open. Follow the homepage to avoid getting lost.📈 $BTC latest updates

As long as $STABLE.C.D closes below the 7.35% level with a 4-hour candlestick,

I will immediately go long on BTC.

We are currently at the end of this critical level.

It means Bitcoin may soon welcome a breakthrough.

But please be sure to wait for this final confirmation, it is very crucial.

As long as $STABLE.C.D closes below the 7.35% level with a 4-hour candlestick,

I will immediately go long on BTC.

We are currently at the end of this critical level.

It means Bitcoin may soon welcome a breakthrough.

But please be sure to wait for this final confirmation, it is very crucial.

BTC0.33%

- Reward

- 1

- Comment

- Repost

- Share

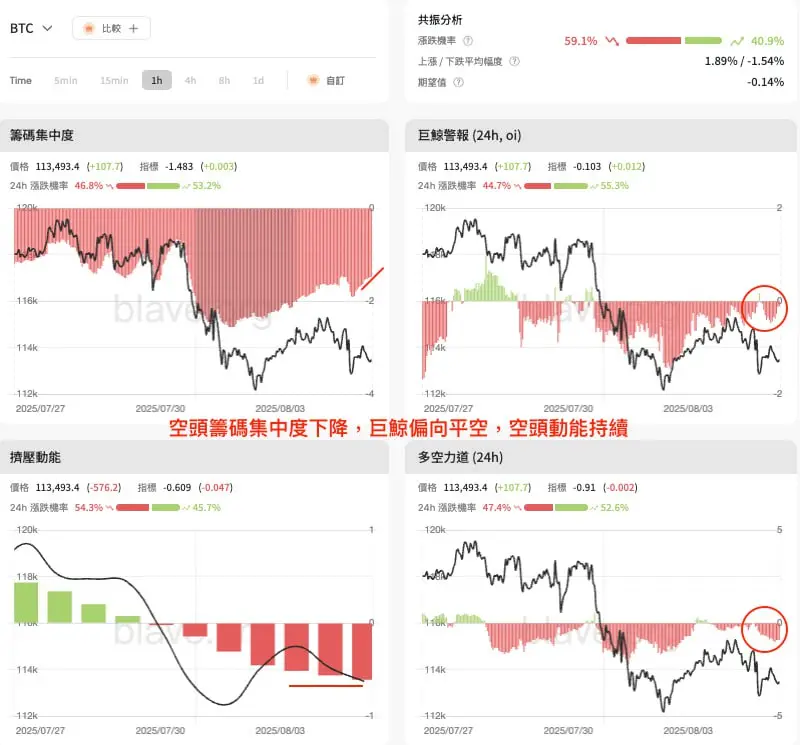

The concentration of short positions for BTC is decreasing, whales are leaning towards closing short positions, the bearish momentum is still present, and the trend has started to enter a short-term bottom phase as mentioned yesterday. According to the liquidation map, the larger long order liquidation area below is around 111k, while the largest short order liquidation area above is around 116k.

Data shows that whales have strong bullish activity towards SOL, while the concentration of short positions for both ETH and SOL is decreasing. Other strong coins selected through the data filter incl

View OriginalData shows that whales have strong bullish activity towards SOL, while the concentration of short positions for both ETH and SOL is decreasing. Other strong coins selected through the data filter incl

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

GateUser-0c6d3cd9 :

:

It should have been delisted long ago.View More

📊 Crypto Assets Fear and Greed Index

🧭 Index value: 54

😱 Emotion: Neutral

💰 BTC Price: 114137 USD

🧭 Index value: 54

😱 Emotion: Neutral

💰 BTC Price: 114137 USD

BTC0.33%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

CryptoLDGrace :

:

📊 Crypto Assets Fear and Greed Index 🧭 Index Value: 54

😱 Sentiment: Neutral

💰 BTC Price: 114137 USD

- Reward

- 1

- Comment

- Repost

- Share

Behind this wave of Ethereum buying frenzy, not only is there the drive of investment enthusiasm, but changes in the policy landscape also play a key role. The recent release of the "Crypto Policy Report" and the "Project Crypto" plan by the White House and the SEC shows that the U.S. government is promoting the on-chain transformation of the traditional financial system, aiming to maintain a leading position in the global digital finance competition. It is worth noting that after in-depth research by several Wall Street banks on major public chains, the one ultimately chosen as the underlying

ETH2.24%

- Reward

- like

- Comment

- Repost

- Share

The current strategy is: if our current Bitcoin short order (which has already taken profit) is exited with a breakeven stop loss, then we will re-enter the short position at the same level (which is the same trading plan as before).

On the other hand, if the price returns to the 4.61% - 4.64% range, that will be a signal for us to go long on Bitcoin.

Finally, I want to say that it is only the beginning of the month now, so don't force yourself to make trades that you will regret later. Not trading is better than making a wrong trade.

On the other hand, if the price returns to the 4.61% - 4.64% range, that will be a signal for us to go long on Bitcoin.

Finally, I want to say that it is only the beginning of the month now, so don't force yourself to make trades that you will regret later. Not trading is better than making a wrong trade.

BTC0.33%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

In simple terms, people's sensitivity to "loss" is greater than the satisfaction derived from "gain." The happiness of earning 1000 yuan pales in comparison to the pain of losing 1000 yuan.

What people fear is not that they haven't made money, but that it seems like they have made money, only to lose it again. It's like when you spent 103,000 to buy ETH, and then ETH rises to 3,900, and you think you have made a 30% profit. At that moment, you believe the numbers on your account are your own money. Then, when ETH drops to 3,400, your subconscious will perceive this as a loss. However, the trut

What people fear is not that they haven't made money, but that it seems like they have made money, only to lose it again. It's like when you spent 103,000 to buy ETH, and then ETH rises to 3,900, and you think you have made a 30% profit. At that moment, you believe the numbers on your account are your own money. Then, when ETH drops to 3,400, your subconscious will perceive this as a loss. However, the trut

ETH2.24%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Accepting losses is the norm, not an accident. This is not a cliché, but the first step in understanding. Any trading system must confront the "probability of making mistakes"; you are not a failure, you are just a participant. Only when the majority loses can a small group make big profits.

Set a plan before entering the market. Many people rush in and then think about what to do. The correct order should be: "First, consider how much loss you can accept, then decide how much you can invest."

Shift your focus from profit and loss to the system. Does your trading system have logic? Does it hav

View OriginalSet a plan before entering the market. Many people rush in and then think about what to do. The correct order should be: "First, consider how much loss you can accept, then decide how much you can invest."

Shift your focus from profit and loss to the system. Does your trading system have logic? Does it hav

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

What is the target for ETH?

5000

1

1

8000

0

0

1 ParticipantsVoting Finished

- Reward

- like

- Comment

- Repost

- Share

Follow important news. The key macroeconomic data to be released next week is as follows:

Wednesday 20:15, the US July ADP employment number is ( million, expected 7.5, previous value -3.5;

On Wednesday at 00:00, He Lifeng, a member of the Central Political Bureau and Vice Premier of the State Council, will visit Sweden from July 27 to 30 for economic and trade talks with the US side.

Thursday 02:00, the Federal Reserve FOMC announces interest rate decision;

Thursday 02:30, Federal Reserve Chairman Powell holds a monetary policy press conference;

Thursday 20:30, the number of initial jobless c

Wednesday 20:15, the US July ADP employment number is ( million, expected 7.5, previous value -3.5;

On Wednesday at 00:00, He Lifeng, a member of the Central Political Bureau and Vice Premier of the State Council, will visit Sweden from July 27 to 30 for economic and trade talks with the US side.

Thursday 02:00, the Federal Reserve FOMC announces interest rate decision;

Thursday 02:30, Federal Reserve Chairman Powell holds a monetary policy press conference;

Thursday 20:30, the number of initial jobless c

ADP-0.22%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

In the crypto market, some say that early positioning relies on luck.

Indeed, there are always those who can establish positions when new projects are just starting out, enjoying the dividends of ecological growth; there are also those who chase highs in the emotional fluctuations of the secondary market, getting trapped.

But is it really like that? I don't think so.

More often, it depends on how they view the market – what tools they use, what judgments they make, and how they try to take control in uncertainty.

The true achievers are often those who think a little more before each step they

Indeed, there are always those who can establish positions when new projects are just starting out, enjoying the dividends of ecological growth; there are also those who chase highs in the emotional fluctuations of the secondary market, getting trapped.

But is it really like that? I don't think so.

More often, it depends on how they view the market – what tools they use, what judgments they make, and how they try to take control in uncertainty.

The true achievers are often those who think a little more before each step they

IKA-0.65%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$ETH update

The price is retracing to the 0.705 Fibonacci retracement level.

If the trend remains healthy (which it does seem to be at the moment),

Then we will soon welcome a new higher high.

To confirm the failure of the upward trend,

The 4-hour closing price has broken below the previous low of $3474.

The price is retracing to the 0.705 Fibonacci retracement level.

If the trend remains healthy (which it does seem to be at the moment),

Then we will soon welcome a new higher high.

To confirm the failure of the upward trend,

The 4-hour closing price has broken below the previous low of $3474.

ETH2.24%

- Reward

- like

- Comment

- Repost

- Share

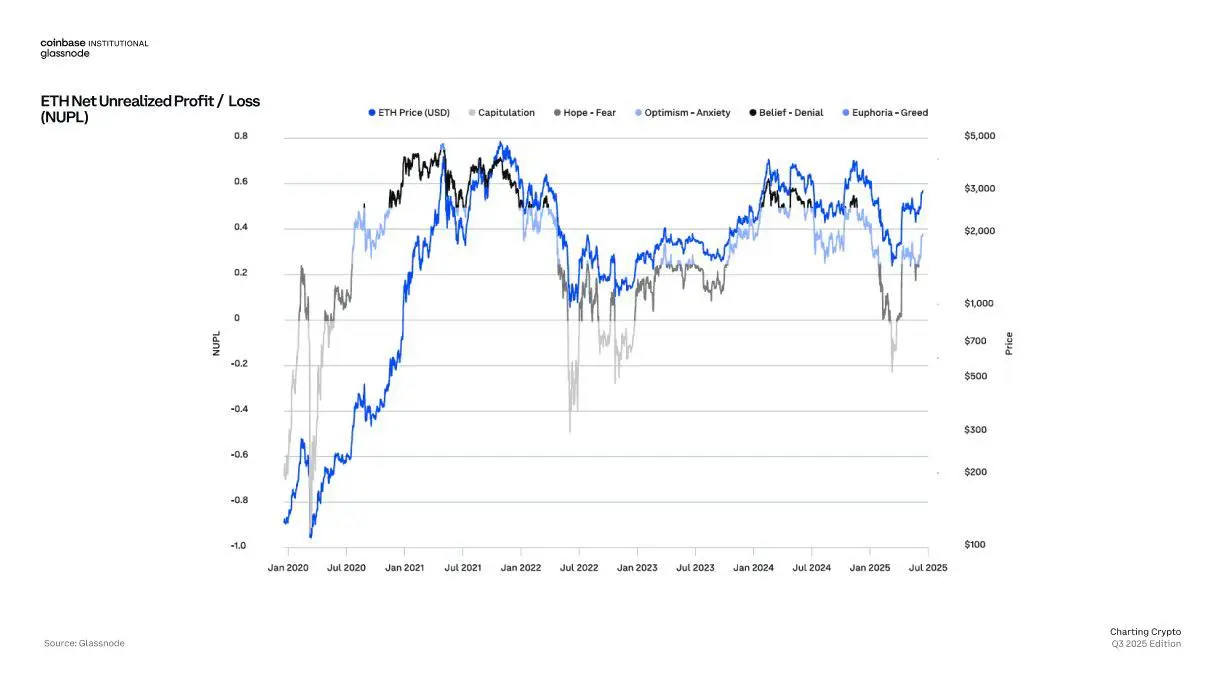

ETH on-chain data turns bullish

NUPL reversed in the second quarter - savvy investors are bottom-fishing.

Subsequently, ETF funds flowed in. Prices soared.

Current:

• The amount of ETH on the exchange decreases

• Holders are unwilling to sell

• MVRV turns bullish

Everyone is waiting for a drop.

But the real action has begun. #ETH突破3600#

NUPL reversed in the second quarter - savvy investors are bottom-fishing.

Subsequently, ETF funds flowed in. Prices soared.

Current:

• The amount of ETH on the exchange decreases

• Holders are unwilling to sell

• MVRV turns bullish

Everyone is waiting for a drop.

But the real action has begun. #ETH突破3600#

ETH2.24%

- Reward

- like

- Comment

- Repost

- Share

News: 🇺🇸 President Trump officially signed the encryption "Genius Act" into law.

Latest news: 🇺🇸 President Trump stated that encryption "has risen more than any stock."

#特朗普施压鲍威尔#

Latest news: 🇺🇸 President Trump stated that encryption "has risen more than any stock."

#特朗普施压鲍威尔#

TRUMP2.82%

- Reward

- like

- Comment

- Repost

- Share

$BTC

$USDT.D has broken below the 4.2% - 4.18% support range on the 4-hour chart.

Currently converting it into resistance.

If this backtest is successful (it looks like the success rate is quite high at the moment),

We will see Bitcoin continue to rise towards $125K.

But please note

Currently, there has not been a daily candlestick that breaks below the previous major low.

Therefore, a formal BOS (Breakout Structure) has not yet formed.

At the same time, the MSL (Market Structure Low) has been moved to the most recent low.

⸻

If you are considering buying, now is a good entry point.

The curren

$USDT.D has broken below the 4.2% - 4.18% support range on the 4-hour chart.

Currently converting it into resistance.

If this backtest is successful (it looks like the success rate is quite high at the moment),

We will see Bitcoin continue to rise towards $125K.

But please note

Currently, there has not been a daily candlestick that breaks below the previous major low.

Therefore, a formal BOS (Breakout Structure) has not yet formed.

At the same time, the MSL (Market Structure Low) has been moved to the most recent low.

⸻

If you are considering buying, now is a good entry point.

The curren

BTC0.33%

- Reward

- like

- Comment

- Repost

- Share

GENIUS Act (stablecoin regulations)

The bill will establish a federal regulatory framework for payment stablecoins, allowing only issuers with specific qualifications such as banks, qualified non-banks, or state-regulated entities to issue stablecoins. It requires that at least 1:1 be fully backed by highly liquid assets (such as cash or U.S. Treasuries), undergo regular reserve audits and public disclosures, and be incorporated into anti-money laundering and consumer protection mechanisms.

At the same time, establish a parallel mechanism for federal and state regulation, and impose federal re

The bill will establish a federal regulatory framework for payment stablecoins, allowing only issuers with specific qualifications such as banks, qualified non-banks, or state-regulated entities to issue stablecoins. It requires that at least 1:1 be fully backed by highly liquid assets (such as cash or U.S. Treasuries), undergo regular reserve audits and public disclosures, and be incorporated into anti-money laundering and consumer protection mechanisms.

At the same time, establish a parallel mechanism for federal and state regulation, and impose federal re

ACT1.48%

- Reward

- like

- Comment

- Repost

- Share