Why Staking Needs a Makeover

This module explains the critical flaws in today’s staking models, from centralization risks to slashing vulnerabilities. It introduces the Ethereum validator cap increase and lays the groundwork for understanding how DVT addresses these problems by distributing validator responsibilities across multiple nodes.

Ethereum PoS System

The Ethereum proof-of-stake (PoS) system relies on a vast network of validators to secure the chain, propose blocks, and maintain consensus. While the PoS upgrade was designed to decentralize the network and lower barriers to participation compared to proof-of-work, the current state of staking has introduced new forms of centralization and risk. Validator infrastructure today is prone to outages, single points of failure, and growing institutional consolidation. These issues threaten the core ideals of Ethereum and create operational bottlenecks that Distributed Validator Technology (DVT) seeks to solve.

Centralization in Ethereum Staking

Although Ethereum staking was built with decentralization in mind, the real-world distribution of validators tells a different story. As of mid-2025, a significant share of Ethereum’s active validators are concentrated in a small number of entities. Liquid staking providers, centralized exchanges, and institutional node operators now manage a majority of validators, raising concerns about control and censorship resistance. For example, platforms like Lido, Coinbase, and Binance collectively account for a large portion of staking volume, which means decisions by a few organizations could potentially influence Ethereum’s block validation process.

This centralization is not only technical but also geographic and regulatory. Many of these providers operate under similar legal regimes, which increases the risk of coordinated slashing or compliance-based censorship if external pressure is applied. The validator set becomes less resilient when too many nodes rely on the same infrastructure provider, cloud region, or country.

Moreover, these dominant entities tend to use internal or proprietary systems to manage validators, which limits transparency and reduces diversity in validator clients and configurations. While this setup improves efficiency for institutions, it creates fragility at the protocol level by concentrating staking power into isolated operational silos.

The Risks of Downtime and Slashing

Running a validator is not without risk. In Ethereum’s PoS design, validators are required to remain online and perform duties accurately. Failure to do so can result in penalties or “slashing,” the forced loss of staked ETH. Slashing is intended as a deterrent against malicious behavior such as double signing or long-range attacks, but in practice, even honest operators can be slashed due to misconfiguration, faulty automation, or infrastructure failures.

A single point of failure, like a server crash or internet outage, can take down an entire validator, resulting in downtime penalties. If the validator misses enough duties, it loses rewards and may be forcibly exited from the active set. Worse, if multiple validators operated by the same entity fail at once (e.g., during a cloud provider outage), correlated slashing can occur. In such events, slashing is compounded across validators, amplifying the financial damage.

This fragility discourages smaller operators from participating, as maintaining perfect uptime and fault tolerance requires significant investment in hardware redundancy, monitoring tools, and incident response systems. Solo stakers, in particular, are vulnerable, as they often run a single-node setup without institutional-grade failover systems. As a result, staking becomes increasingly skewed toward professional operators with the resources to mitigate operational risk.

Ethereum’s Pectra Upgrade and the Validator Cap Expansion

Source: Gate.com

Ethereum’s upcoming Pectra hard fork will increase the effective validator balance cap from 32 ETH to 2,048 ETH. This means a single validator can now be responsible for a much larger amount of stake. While this improves protocol scalability and reduces communication overhead, it has direct consequences for validator diversity.

Under the current 32 ETH model, large holders must spin up many separate validators to stake significant amounts. This spreads responsibilities across multiple validator keys, which can—at least theoretically—be distributed among different entities or systems. With the new 2,048 ETH cap, a single validator can control what previously required over 60 validators. This consolidation reduces operational complexity but also centralizes power, especially in the hands of liquid staking providers and custodians who aggregate user deposits into high-value validator instances.

For solo stakers and smaller operators, this upgrade further tilts the playing field. They are unlikely to manage validators with such high balances, which means their influence relative to large operators will shrink even further. The cost of failure for these larger validators also rises, since any slashing event now affects much greater sums. Without additional mechanisms for decentralizing validator operations, this upgrade could accelerate Ethereum’s drift toward a more centralized staking landscape.

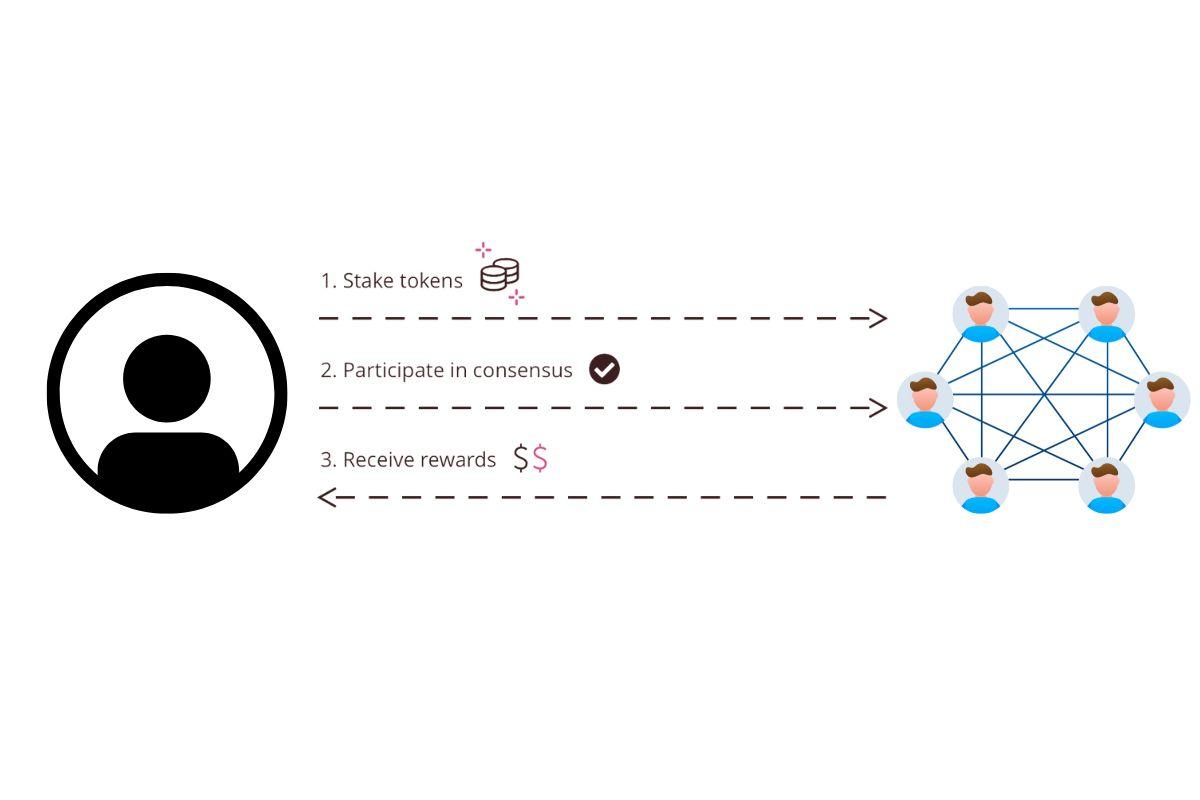

The Emergence of Distributed Validator Technology (DVT)

Distributed Validator Technology (DVT) emerges in this context as a structural improvement to the validator model. Instead of relying on a single machine or operator to manage a validator key, DVT splits the validator’s responsibilities across multiple independent nodes operated by different parties. Using threshold cryptography and secure multi-party computation, DVT allows these nodes to coordinate and perform validator duties collectively, without any single node holding the full key or acting alone.

This distributed architecture dramatically improves fault tolerance. If one or more nodes in a DVT cluster go offline, the validator can continue to function as long as a minimum quorum of participants remain active. This eliminates the need for expensive backup systems or 24/7 monitoring by a single operator. It also makes slashing far less likely, since the risk of misbehavior is spread across multiple actors who must collude to trigger a violation.

From a decentralization standpoint, DVT enables multi-party validator setups, where different individuals, organizations, or communities can co-manage a validator. This redistributes power, increases geographic and technical diversity, and reduces the systemic risk associated with validator monopolies. Importantly, DVT is compatible with existing consensus clients and validator software, which allows it to be integrated into Ethereum without protocol-level changes.

As Ethereum continues to evolve and validator responsibilities become more concentrated, DVT provides a pathway to preserve the decentralization, resilience, and openness that the network depends on. It reimagines the validator role as a shared responsibility, one that aligns more closely with the collaborative nature of blockchain itself.